Mastering Bitcoin Self-Custody: A Comprehensive Guide

Written on

Understanding Bitcoin's Influence

Bitcoin is significantly reshaping the financial landscape. Its increasing adoption and rising value have captured global attention. Major investors and nations are embracing this cryptocurrency, yet it remains under scrutiny from various critics. The remarkable aspect of Bitcoin lies in its decentralized, open-source nature, which ensures its resilience against shutdowns. When you possess Bitcoin and opt for self-storage, you alone hold access to your asset. This grants you unprecedented control over your monetary resources, a level of sovereignty previously unseen in the digital era.

Self-Custody Explained

Self-custody is a term frequently encountered in discussions about Bitcoin and cryptocurrency. In essence, it refers to the practice of maintaining sole ownership of your digital assets. This unique form of custodianship empowers individuals by eliminating the need for intermediaries like banks or exchanges, which often have access to your funds and can impose restrictions or face risks of fraud.

The Concept of Bearer Instruments

Self-custody in Bitcoin mirrors traditional financial practices where ownership was defined by possession. Historically, instruments like banknotes and stock certificates functioned as bearer instruments, granting ownership to whoever physically held them. In Bitcoin, true ownership is determined by possessing the private keys to a wallet. A common adage in this space states, "not your keys, not your coins." If you are uncertain about your ownership status, it’s likely that you don’t have complete control. Remember, with great responsibility comes great power.

The Resilience of Bitcoin

When you self-custody your Bitcoin, it remains immune to censorship. Unlike assets held on exchanges, which may be frozen or restricted, self-custody ensures that only you can manage your transactions. The potential for external intervention exists only if someone compels you to relinquish access to your wallet.

Financial Inclusion and Self-Custody

At the core of self-custody lies the principle of financial inclusion. By self-custodying your Bitcoin, you are free to engage with the global monetary system without interference. Bitcoin is available to anyone with internet access, independent of their personal circumstances. Traditional banking systems can impose restrictions, but self-custody allows for a more democratized access to financial resources.

Step-by-Step Guide to Self-Custody

Install the Muun Wallet App

Muun is compatible with both iOS and Android devices.

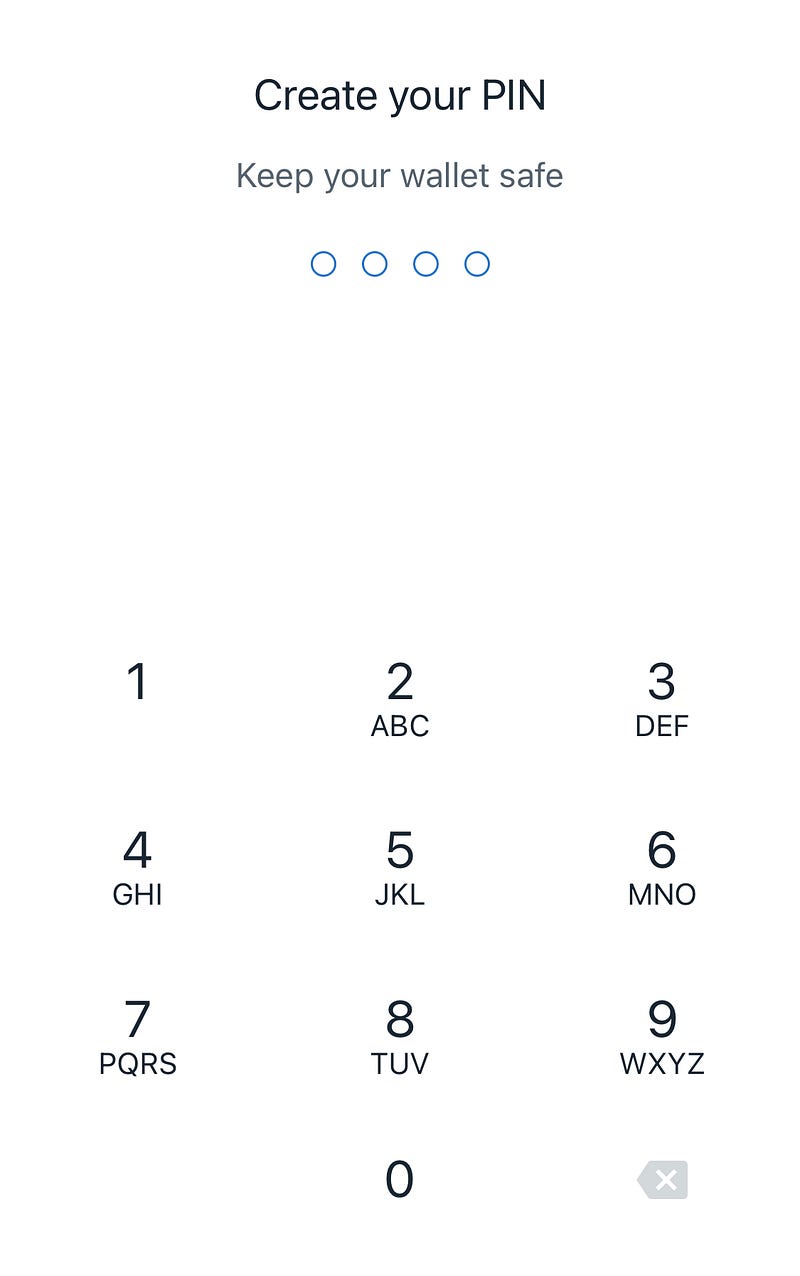

Set Up a Secure PIN

Upon your first use, you will be prompted to create a secure four-digit PIN for accessing your wallet.

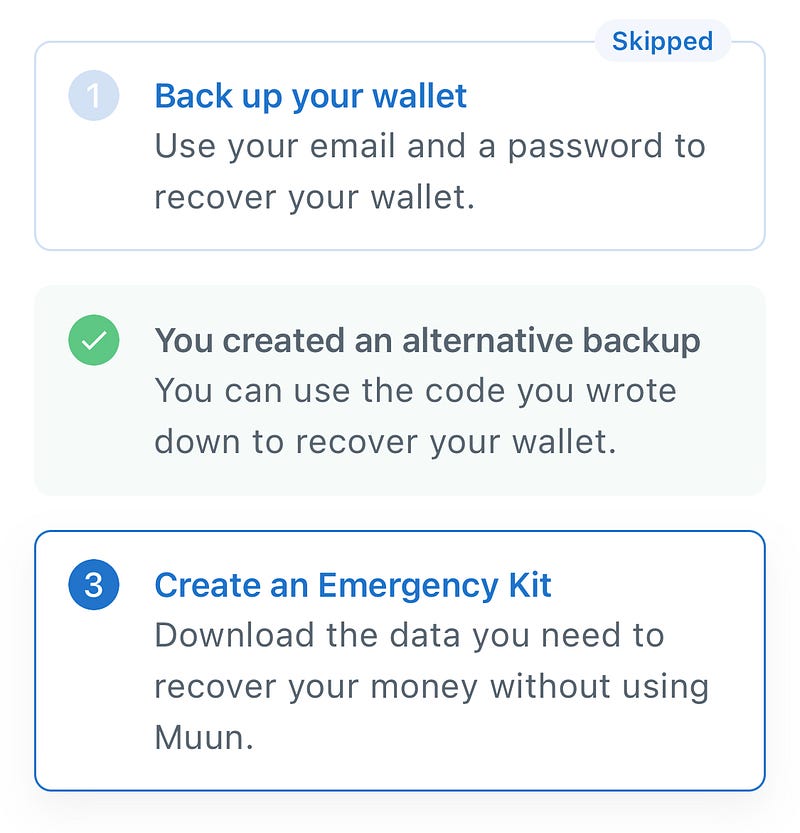

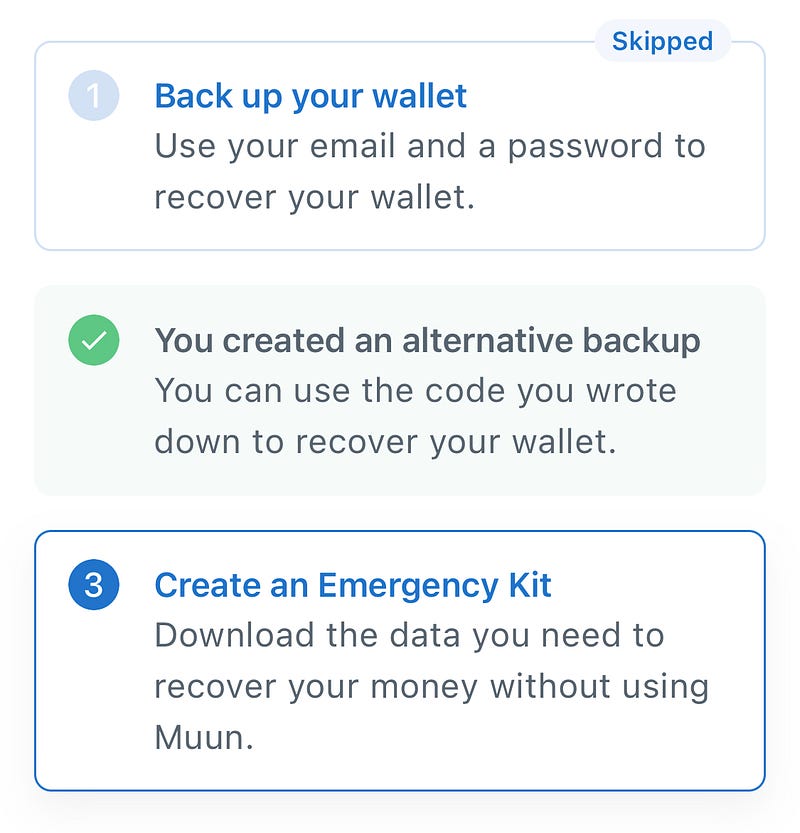

Backup Your Wallet

Muun offers two primary methods for backing up your wallet: via email or an alternative secure backup. The former connects your wallet to your email, while the latter offers enhanced security without personal identifiers.

Write Down Your Recovery Code

If you choose the alternative backup, you will receive a recovery code. Write this down and store it securely, avoiding digital storage methods like screenshots.

Start Transacting with Bitcoin

Congratulations! With your wallet set up, you can now send and receive Bitcoin.

If you've followed these steps, you've successfully established self-custody over your Bitcoin. Note that Muun is dedicated solely to Bitcoin and does not support altcoins like Ethereum. For those interested in altcoin storage, consider hardware wallets such as Ledger or Trezor.

Ensuring Security

Always keep your device secure, especially if you hold a substantial amount of Bitcoin. Protect your PIN and recovery phrase from unauthorized access.

Best Practices for New Users

After creating your Muun wallet and documenting your recovery phrase, familiarize yourself with the wallet's functionalities.

Recommended Steps:

- Send a small amount of Bitcoin to your Muun wallet.

- Verify your recovery phrase is correctly noted.

- Delete and reinstall the app to test recovery.

- Confirm your funds remain accessible.

Preparing for Emergencies

You can also prepare for unexpected situations by creating an emergency kit within the Muun app.

Avoid cloud backups for your emergency kit, as they may compromise security. Instead, consider printing a physical copy for safekeeping.

Conclusion

You are now equipped to self-custody your Bitcoin using the Muun wallet. While other options exist that may support altcoins or provide hardware devices, starting small with Muun is a prudent approach.

Security vs. Convenience

Balance is key when holding Bitcoin; choose a storage solution based on your intended use.

Continue Learning

Take your time to explore Bitcoin, self-custody practices, and diverse storage solutions.

For more guidance, check out our comprehensive resource on Bitcoin wallets.

The first video, "How to Set Up Bitcoin Multisig Self-Custody with Casa: Easy Step-by-Step Tutorial," provides insights into setting up secure self-custody options.

The second video, "How To Self Custody Your Bitcoin," offers essential tips for managing your Bitcoin securely.

Bitcoin offers individuals the opportunity for financial empowerment worldwide through both self-custody and mainstream solutions. Remember, you have options, and self-custody is just one of them. Thank you for reading!