Bitcoin's Price Surge: Are We Witnessing a Bull Market Revival?

Written on

The Resurgence of Bitcoin

I can distinctly recall when Bitcoin was valued at $17,900—just last month, in fact. As of this Wednesday, its price has climbed to $24,200, marking a remarkable 35% increase in a matter of weeks. This kind of volatility is certainly captivating.

Is the bull market making a comeback reminiscent of 2021 or even 2017? Those years saw Bitcoin experience some dramatic surges, reaching $69,000 last year and soaring from $1,000 to $19,000 in 2017. Regardless of one's opinion on Bitcoin, it certainly knows how to keep things interesting.

Bitcoin's Correlation with Tech Stocks

One of my ongoing frustrations is Bitcoin's recent tendency to move in sync with tech stocks. I've discussed this correlation numerous times, and it defies explanation. Since July 14th, both Bitcoin and the NASDAQ index have been on an upward trajectory.

In theory, Bitcoin should remain unaffected by corporate earnings, interest rate changes, supply chain disruptions, or inflation data. Yet, here we are, witnessing this unusual correlation. As I've stated repeatedly, Bitcoin is often misunderstood, and we are still at the early stages of its journey.

Is This Rally Merely a Dead-Cat Bounce?

The term "dead-cat bounce" refers to the concept that even a deceased cat will bounce if it falls from a great height. It's often characterized as a temporary rally that misleads investors. Critics of Bitcoin argue that we are headed for lower prices and that this recent increase is simply a fleeting uptick. However, I would venture to say that this isn’t merely a "sucker’s rally." There are too many informed Bitcoin investors committed to accumulating more. They recognize the long-term potential of the technology and understand that external economic factors cannot undermine Bitcoin's value.

Looking Ahead: Plans for $100K Celebrations?

Are we dusting off our Laser Eyes for a potential $100K celebration? What’s fueling this price increase? Ultimately, Bitcoin continues to perform as it always has—functioning securely and consistently without disruption. It remains indifferent to stock market fluctuations or economic indicators.

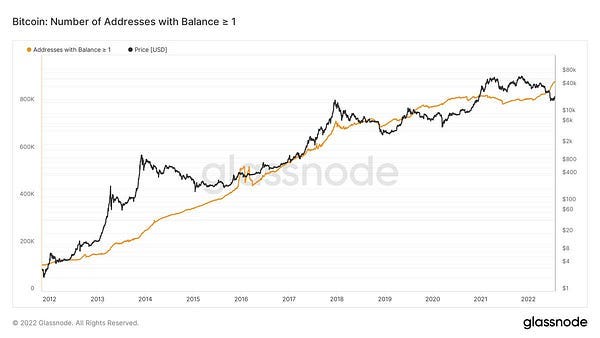

So what is propelling us upward amid a backdrop of troubling economic news, lackluster corporate earnings, and rampant inflation? I genuinely believe that the increasing adoption of Bitcoin is a key factor. More and more individual investors, often referred to as "plebs," are starting to invest and consistently dollar-cost averaging into Bitcoin. This "DCA Army" is dedicated to Bitcoin's future, regardless of the surrounding market noise.

The growth in accumulation among smaller investors and the rising number of Bitcoin addresses is evident in the following chart:

Have we identified a cycle bottom? I believe we have reached a range that might be considered a cycle low. Despite negative economic indicators and the fallout from crypto exchanges and stablecoins, Bitcoin, often dubbed "The King," has proven to be remarkably resilient.

Will we see a spike to $100,000 this year? While I can't say for certain, Bitcoin has exhibited similar explosive runs in the past. It's a possibility I wouldn't discount.

Subscribe on Substack — Always Free!

Stay updated with every article from Rick Mulvey (and countless others on Medium). Your subscription directly supports independent writing.

New to trading? Consider exploring crypto trading bots or copy trading.