# The $6 Billion Excel Error: A Lesson from JP Morgan's London Whale

Written on

Chapter 1: Introduction to the London Whale Incident

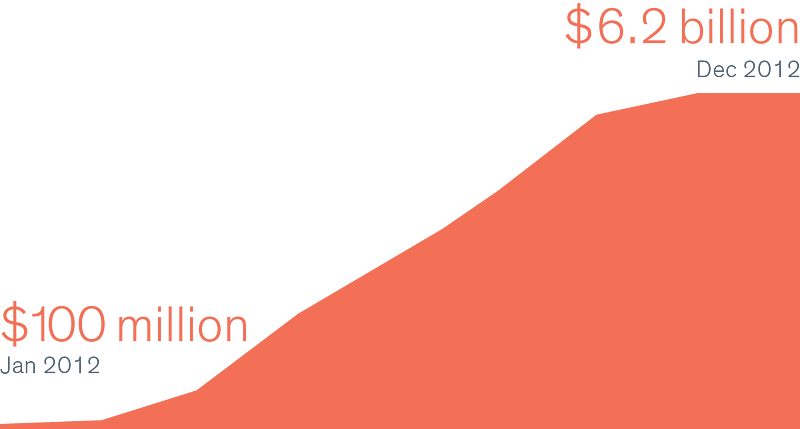

In 2012, JP Morgan Chase, a prominent player in the financial services industry, encountered a staggering loss of $6 billion due to a minor error in their Excel-based Value-at-Risk (VaR) model. This event, commonly referred to as the London Whale Loss, originated from a seemingly innocuous spreadsheet.

The incident stemmed from an employee’s erroneous data transfer that escalated into a significant financial disaster.

Chapter 2: The Excel Error Explained

At the core of this financial fiasco was a straightforward mistake in Excel. An employee, pressed to expedite the review process, incorrectly utilized a sum total rather than an average during the data transfer. This seemingly minor oversight disrupted risk assessments and created a misleading representation of the actual risks involved.

Section 2.1: Operational Oversights

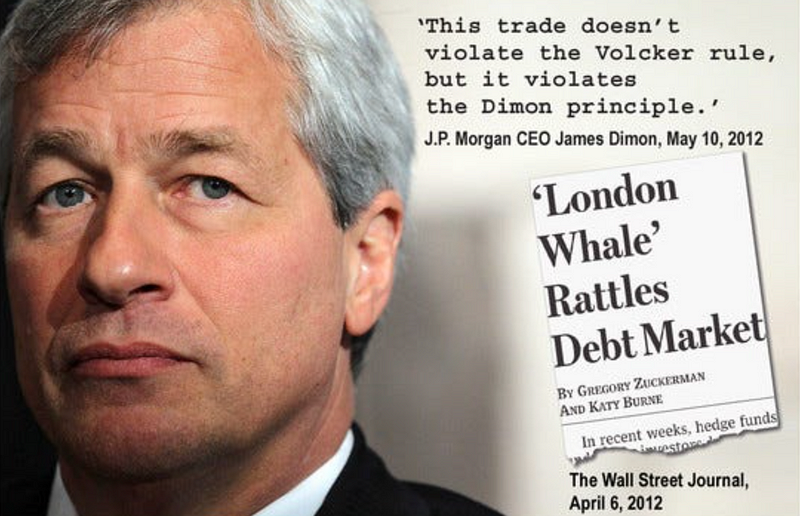

However, the loss was not merely the result of a faulty formula. A detailed 129-page internal report from JP Morgan revealed a deeper narrative of operational risks and neglect of internal controls.

The Excel model at the heart of the crisis had not received proper approval, and its creator had warned against its usage. This situation raises significant concerns about the company's approval protocols and the pressures employees faced to accelerate crucial financial reviews.

Section 2.2: Understanding VaR Models

It's vital to clarify a common misconception regarding VaR models. While they play an essential role in risk management, they do not cause financial losses. Instead, they serve as instruments to estimate potential losses within a defined confidence interval.

In the case of the London Whale, the VaR model itself wasn't the source of the financial turmoil; rather, it was the failure of other risk models, stress tests, and a willful disregard for acknowledged risks. The JP Morgan report illustrates a firm aware of its challenges yet choosing to navigate through them recklessly.

Chapter 3: Key Takeaways and Lessons Learned

As the repercussions of the London Whale incident unfolded, it transformed into a critical case study in risk management. It serves as a poignant reminder that operational inefficiencies, lapses in internal controls, and intentional ignorance can exacerbate even the most advanced risk management systems.

The aftermath highlighted the necessity for automation in financial modeling. Relying on manual operations in such intricate environments significantly elevates the risk of errors. The London Whale event underscores the urgent need for robust automated solutions that not only enhance efficiency but also reduce the likelihood of human mistakes.

Conclusion: Rethinking Financial Risk Management

The London Whale loss remains a crucial chapter in financial history, emphasizing the vital importance of effective risk management. This incident, ignited by a seemingly trivial Excel error, underscores the imperative for financial institutions to revisit their risk cultures, fortify internal controls, and harness the advantages of automation.

Sincerely,

The Pareto Investor

My book, “The Little Principle That Beats the Market,” is a must-read for anyone looking to enhance their investment strategies.